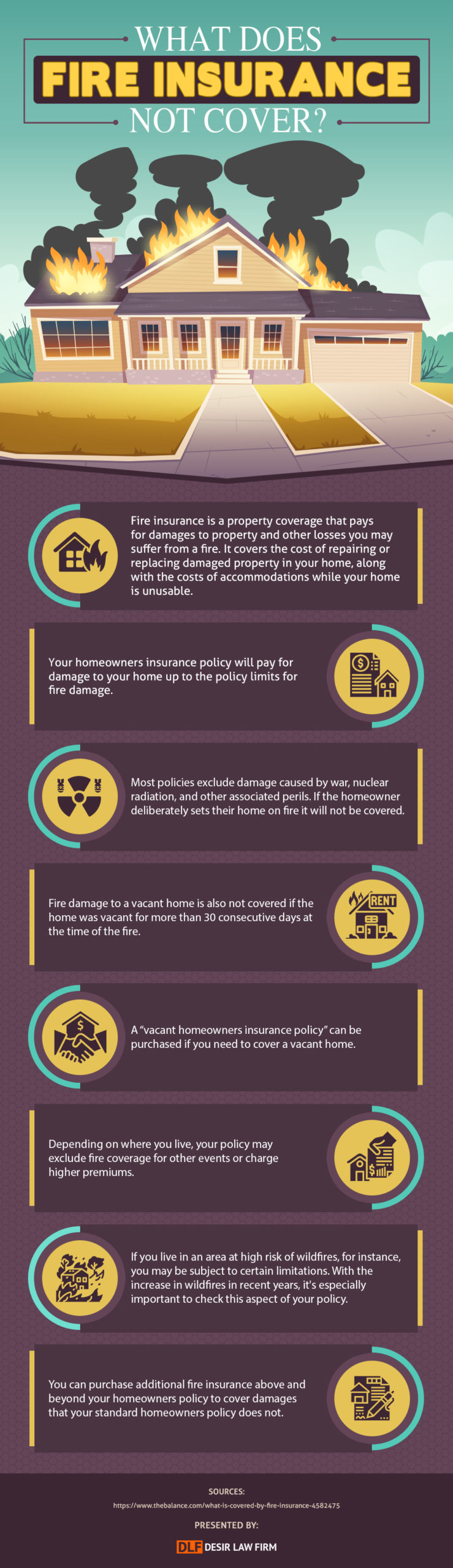

Fire insurance typically covers damage or loss caused by fire to your property, including your home or business. However, there are some things that fire insurance may not cover, such as:

Arson: Fire insurance policies do not cover losses caused intentionally, such as by arson or vandalism.

Negligence: If the fire is caused by your own negligence, such as leaving a stove on or failing to maintain your electrical system, the insurance policy may not cover the damage.

Flood or water damage: Fire insurance does not cover damage caused by floods or water damage, even if it was caused by the efforts to put out the fire.

Earthquakes: Fire insurance typically does not cover damage caused by earthquakes or other natural disasters.

War or terrorism: Fire insurance policies may exclude coverage for losses caused by war, terrorism, or other acts of violence.

Business interruption: Fire insurance may not cover lost income or other financial losses that result from business interruption caused by the fire.

It is important to carefully review your fire insurance policy to understand what is covered and what is excluded. You may need to purchase additional coverage, such as flood insurance or business interruption insurance, to protect yourself fully. For more detail, please refer to the info-graphic below.